SME Valuation in Singapore 2025 Explained: Practical Benchmarks, Industry Factors, and Deal-Ready Adjustments

Table of Contents

- Overview: Why SME Valuation in Singapore Is Different in 2025

- Practical Benchmarks: What Multiples Look Like for Singapore SMEs

- Industry Factors and the New Weight of Intangible Assets

- Deal-Ready Adjustments: Turning a Good Business into a Bankable Asset

- Positioning Your SME for Sale or Investment in 2025

- Conclusion: Build Value Now, Don’t Wait for the Exit

- FAQ

- Work with Bizlah

Overview: Why SME Valuation in Singapore Is Different in 2025

Expert Insight: According to IPOS, analysts attributed PropertyGuru’s 52% acquisition premium (about US$1.1 billion) to its strong intangible assets—such as its proprietary real estate technology platform, brand recognition in Southeast Asia, and marketplace network effects—and the article stresses that systematically identifying, assessing, and valuing such intangible assets is critical to unlocking business growth potential (https://www.ipos.gov.sg/news/news-collection/why-identifying-and-valuing-intangible-assets-is-good-for-business/). (www.ipos.gov.sg)

In 2025, SME valuation in Singapore is being shaped by three converging trends: higher interest rates and tighter credit, more sophisticated buyers using data-led valuation platforms, and policymakers pushing harder on productivity, innovation and intangibles. Learn more: Sell or Buy a Business.This means your business is no longer judged only on last year’s profit; buyers want to see sustainable cash flow, defensible competitive advantages, and clean, verifiable numbers.

For owners exploring a business for sale in Singapore, or simply preparing for future exits, understanding how market participants think about value is now essential. Global deal advisers like PwC and valuation data providers such as MarktoMarket point to the same reality: multiples are becoming more nuanced, and intangible assets account for a rising share of enterprise value.

This article focuses on three practical areas SME owners can control in 2025: realistic valuation benchmarks, industry and intangible-asset factors, and specific “deal-ready” adjustments that improve price and close-ability.

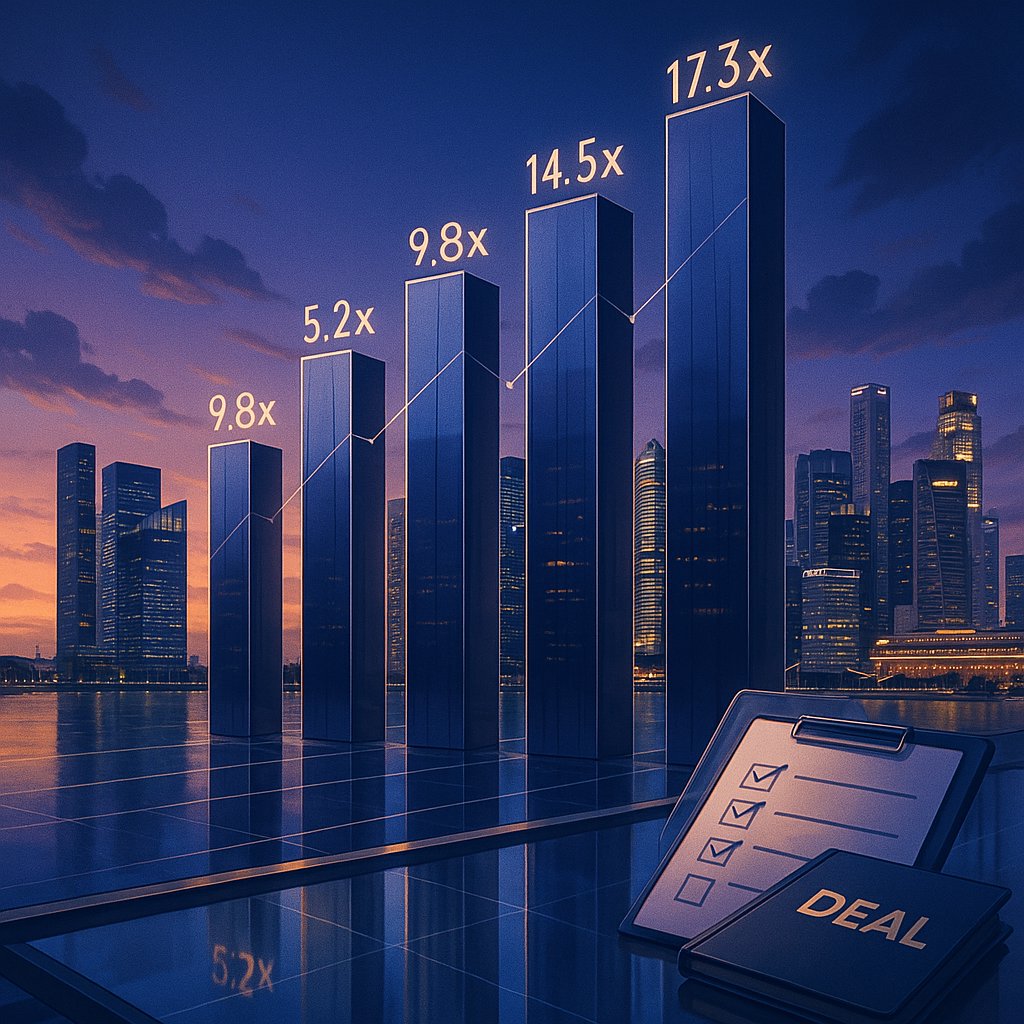

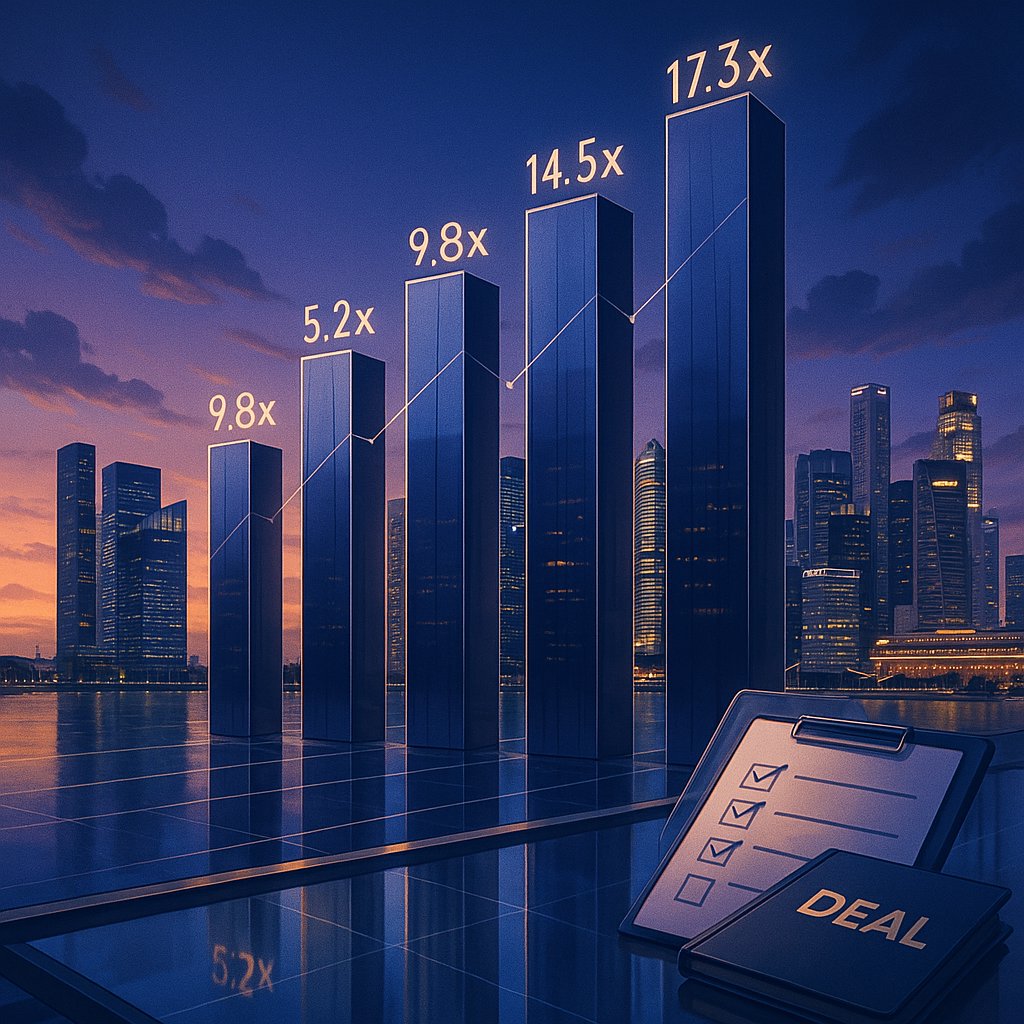

Practical Benchmarks: What Multiples Look Like for Singapore SMEs

SME owners often ask, “What multiple can I expect?” While every transaction is unique, market data and deal advisers tend to converge on certain ranges for profitable, well-run SMEs in a stable economic climate. In 2025, with cautious sentiment and higher financing costs, buyers are particularly sensitive to quality of earnings and cash conversion.

For owner-managed businesses with clean books and diversified customers, indicative valuation benchmarks often fall into these broad bands (before detailed due diligence and adjustments):

- Service and B2B consulting SMEs: 3.0–6.0x normalised EBITDA, depending on contract visibility, reliance on key individuals, and presence of proprietary know-how.

- Asset-light technology and software: 4.0–8.0x EBITDA or 1.5–4.0x recurring revenue, with higher multiples for sticky subscriptions, strong IP and low churn.

- Traditional trading, distribution and light manufacturing: 2.5–5.0x EBITDA, influenced by working capital intensity, supplier dependence and customer concentration.

- Consumer, F&B and retail: 2.0–4.0x EBITDA for single outlets or small chains; strong brands and scalable concepts can stretch this higher.

These ranges are narrower than those observed for large listed companies such as those in the Forbes Global 2000, where deep capital markets and liquidity justify premiums. SME valuations in Singapore must also reflect the realities of limited buyer pools, succession risk and limited management depth.

Marketplaces and brokers tracking business for sale in Singapore listings show that asking prices often start above these ranges, but completed deals typically cluster closer to conservative benchmarks unless the seller can prove exceptional growth, strong recurring revenue or valuable intangibles.

Benchmarks should be treated as a starting grid, not a final verdict. Buyers will refine them using:

- Normalised earnings: stripping out one-off items, owner perks, and non-business expenses.

- Working capital needs: businesses that require large ongoing inventory or receivables tend to command lower multiples.

- Capex intensity: higher replacement capex reduces free cash flow and therefore valuation.

Your task as a seller is to anticipate these adjustments before going to market, so negotiations focus on strategic upside instead of accounting clean-up.

Industry Factors and the New Weight of Intangible Assets

Industry context is a major driver of SME valuation. In Singapore, the 2025 policy focus on digitalisation, sustainability and innovation – highlighted in KPMG and SID’s Budget 2025 recommendations – is nudging capital towards sectors positioned for productivity and exportable know-how.

Sector-specific factors typically affect valuation as follows:

- Regulated and capital-heavy industries (e.g. financial services, healthcare facilities) face higher compliance costs but can benefit from barriers to entry and licensing advantages.

- Digital and IP-led sectors (software, fintech, data analytics) can achieve higher multiples when they demonstrate proprietary technology, defensible data and scalable margins.

- Consumer and F&B rely more on brand strength, location, customer loyalty and franchise potential than tangible assets alone.

- Export-oriented manufacturers gain value from certifications, process know-how, and long-term OEM / ODM relationships, not just plant and equipment.

The Intellectual Property Office of Singapore (IPOS) notes a sharp global rise in intangible value, with corporate intangibles reaching US$79.4 trillion in 2024 and accounting for around 90% of S&P 500 corporate value. Within ASEAN, recognised intangible assets on balance sheets grew from S$6.5 billion in 2005 to S$47.5 billion in 2022, yet this still understates total intangible-driven value.

For SMEs, the most relevant intangible assets include:

- Intellectual property (IP): patents, trademarks, copyrights, designs, trade secrets and proprietary algorithms.

- Software and proprietary data: in-house platforms, databases, analytics models and process automation.

- Customer relationships: long-term contracts, subscription bases, key accounts and recurring revenue streams.

- Brand and goodwill: market reputation, online reviews, recognisable trade names, and network effects.

Deals like the 2024 acquisition of PropertyGuru by EQT Private Capital Asia, at an estimated US$1.1 billion valuation and premium over its stock price, underline how robust platforms, brand recognition, and marketplace scale can strongly influence price.

Singapore is actively building frameworks to bring clarity to these intangibles. The Intangibles Disclosure Framework (IDF) and the FIND programme encourage structured reporting on technology and customer-related assets, while professional bodies are developing formal valuation guidelines for intangibles. As these practices mature, SMEs that document and evidence their IP, data and customer assets can justify higher multiples and attract better financing, including emerging IP-backed funding solutions seen in markets like the UK.

Deal-Ready Adjustments: Turning a Good Business into a Bankable Asset

In 2025, buyers, lenders and investors are stricter about what they will pay for. The gap between “nice business” and “bankable, financeable asset” is often bridged by targeted adjustments well ahead of a sale or fundraising. These involve both financial clean-up and operational de-risking.

Key practical adjustments include:

- Normalising owner compensation and perks

Recast your profit and loss (P&L) to show market-level salaries for owner-managers and strip out personal benefits (cars, travel, family payroll). This boosts reported EBITDA transparently and aligns with how professional buyers evaluate businesses. - Separating personal and business assets

Where possible, formalise leases for personally owned properties, vehicles or equipment and avoid intermingling personal loans with business borrowings. Clean asset and liability schedules reduce due diligence friction and valuation discounts. - Documenting contracts and IP

Ensure key customer, supplier and employment agreements are in writing and assignable. Register trade marks and relevant IP, and keep up-to-date records of software ownership, licences and source code access. These steps convert “implicit” goodwill into recognisable value. - Reducing concentration risks

High dependence on one customer, supplier, or founder severely drags down multiples. Mitigate this by broadening your base, introducing second-line management and formalising processes so the business can run without the owner’s constant presence. - Improving working capital discipline

Shorten receivables cycles, manage inventory levels and tighten credit terms where feasible. When buyers see strong cash conversion, they can justify stronger valuations even in a cautious credit environment.

Access to financing remains a core concern for SME buyers and successors. Banks and alternative lenders continue to offer a range of options – term loans, working capital lines, and government-assisted schemes – as profiled in platforms such as SingSaver’s comparison of the best SME business loans in Singapore. The more “deal-ready” and transparent your numbers and collateral (including intangibles), the easier it is for buyers to secure leverage and meet your price expectations.

Professional deal advisers like those at PwC and other M&A specialists increasingly emphasise sell-side preparation – from quality-of-earnings reviews to vendor due diligence – because they know that eliminating surprises upfront often translates directly into better pricing and smoother closings.

Positioning Your SME for Sale or Investment in 2025

With more buyers benchmarking opportunities side by side using online marketplaces and data-led platforms, the way you present your business matters as much as the underlying numbers. Whether you intend to sell a minority stake, bring in a strategic investor, or divest fully, positioning is critical.

Practical positioning steps include:

- Clarify your narrative

Frame your business around a clear value proposition, growth story and strategic options (geographic expansion, new products, franchising, or digital transformation). Link this story to tangible metrics – retention rates, margin expansion, customer lifetime value. - Back claims with data

Prepare concise management packs: three to five years of financials, customer and product breakdowns, cohort data for recurring revenue, and pipeline visibility. Buyers are sceptical of verbal assurances without corresponding data trails. - Show how capital will be used

If you are raising funds rather than exiting, articulate exactly how new capital drives value – for example, automation that lifts productivity, a software build that converts project work to subscriptions, or regional expansion that leverages existing IP. - Align with policy tailwinds

Programs tied to Singapore’s Budget 2025 proposals – such as incentives for intangibles, digitalisation and green investments, as flagged by KPMG Singapore’s Budget 2025 proposals – can reinforce your strategic positioning and help buyers underwrite higher growth assumptions.

If you are exploring a full or partial exit, using a curated marketplace for business for sale in Singapore listings can expand your buyer pool and provide real-time feedback on pricing and deal terms. A well-prepared listing that highlights normalised earnings, documented intangibles and clear growth levers stands out sharply from generic advertisements.

The same principles are increasingly relevant even in newer segments like digital assets and crypto-related ventures, where post-2025 test runs of crypto IPOs – as reported by CoinDesk – show that investors are demanding rigorous governance, transparent earnings models and auditable data before awarding tech-style multiples.

Conclusion: Build Value Now, Don’t Wait for the Exit

SME valuation in Singapore in 2025 is less about chasing the highest headline multiple and more about building a business that withstands scrutiny, secures financing and attracts serious buyers. Practical benchmarks give you a realistic starting point, industry and intangible-asset dynamics explain why some firms trade at a premium, and deliberate deal-ready adjustments close the gap between theoretical value and what someone will actually pay.

Whether you aim to list your company as a business for sale in Singapore, bring in partners, or simply future-proof succession, start early. Clean up your numbers, document your intangibles, reduce concentration risks and shape a clear, data-backed growth story. Doing this work now not only improves your eventual exit price but also creates a stronger, more resilient SME that can weather policy shifts, financing cycles and competitive pressure.

FAQ

Q: How do buyers typically value SMEs in Singapore in 2025?

A: Most buyers use a combination of EBITDA multiples, discounted cash flow (DCF), and sometimes asset-based valuation for asset-heavy businesses. The final price often reflects both market benchmarks for your sector and a negotiation around risk, growth potential, and how dependent the business is on the owner.

Q: What valuation multiples are common for Singapore SMEs today?

A: For profitable SMEs, EBITDA multiples often range from about 3x–7x, depending on size, sector, and growth. Tech, healthcare, and niche B2B services may see higher multiples, while highly competitive or low-margin sectors tend to sit at the lower end.

Q: Which factors most strongly increase an SME’s valuation in Singapore?

A: Consistent profits, predictable cash flow, diversified customers, and recurring revenue models are key value drivers. Strong management teams, clear systems, and demonstrable growth potential also push valuations up because they reduce perceived buyer risk.

Q: How can I make my business more ‘deal-ready’ before selling or raising funds?

A: Clean up financials (separating personal and business expenses), formalise contracts with key customers and suppliers, and document processes so the business is less owner-dependent. Preparing a simple data room with up-to-date financials, KPIs, and legal documents also speeds up due diligence and supports a stronger price.

Q: Do intangible assets really matter for SME valuations in Singapore?

A: Yes, intangible assets like brand strength, proprietary technology, customer data, and exclusive distribution rights can justify higher multiples. They help demonstrate competitive advantage, pricing power, and scalability, which are exactly what sophisticated buyers and investors pay a premium for.

Related Reading

Work with Bizlah

consultative CTA — explore Sell or Buy a Business.

- Local expertise in Singapore

- End-to-end guidance

- Transparent valuation

Informational only; not financial advice.