Automation Strategy for Singapore Entrepreneurs: From Workflow Design to Exit Value

Table of Contents

- Overview: Why Automation Strategy Now Matters More Than the Tools

- Designing an Automation Roadmap: From Sales to Financial Reporting

- Industrial, Building and Factory Automation: What SME Owners Should Watch

- Financing Automation: Credit, Cash Flow and Risk Management

- Automation, Exit Strategy and Buying a Business for Sale in Singapore

- Conclusion: Treat Automation as a Long-Term Capability, Not a One-Off Project

- FAQ

- Work with Bizlah

Overview: Why Automation Strategy Now Matters More Than the Tools

Expert Insight:

According to sales automation experts at HashMicro, the global sales automation market is projected to grow at an 8.6% CAGR through 2030, with adoption in Singapore accelerating particularly among SMEs seeking faster, more efficient growth (https://www.hashmicro.com/blog/sales-automation-tools/). They highlight that tools like HashMicro CRM Sales—which offers lead management, automated scheduling, and real-time analytics—are key to streamlining end-to-end sales processes. (www.hashmicro.com)

In Singapore, automation is no longer just about installing software or robots; it is about redesigning how your business works end-to-end. Learn more: Sell or Buy a Business.From intelligent automation in financial reporting to sales automation and factory control systems, the local market is moving towards integrated, data-driven operations.

Regulators, banks and investors increasingly expect SMEs to demonstrate predictable processes, clean numbers and scalable systems. Whether you are growing an existing company or assessing a business for sale in singapore, your automation strategy now influences financing, valuation, and exit options.

This article focuses on how Singapore entrepreneurs and buyers can approach automation as a strategic asset: mapping high-impact processes, choosing the right blend of intelligent automation and control technology, and aligning implementation with cash flow, credit management and long-term value creation.

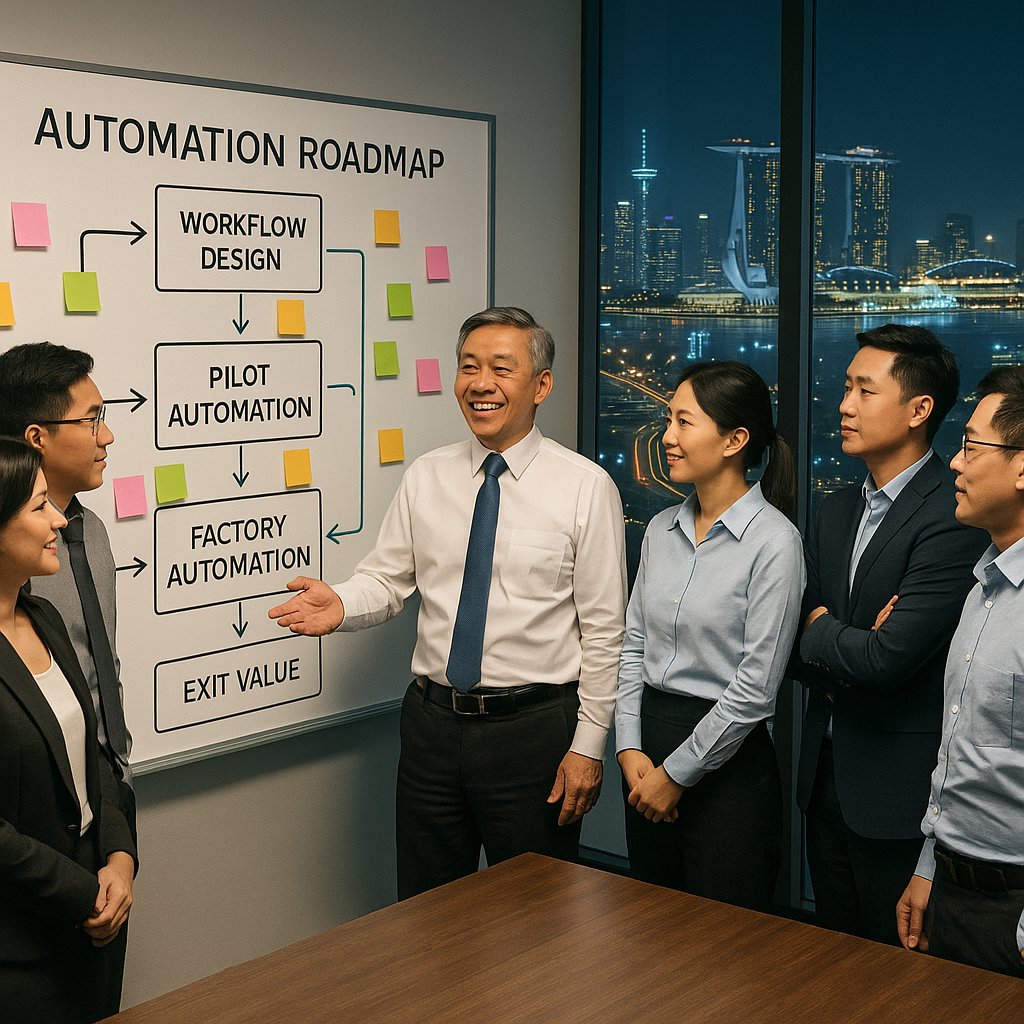

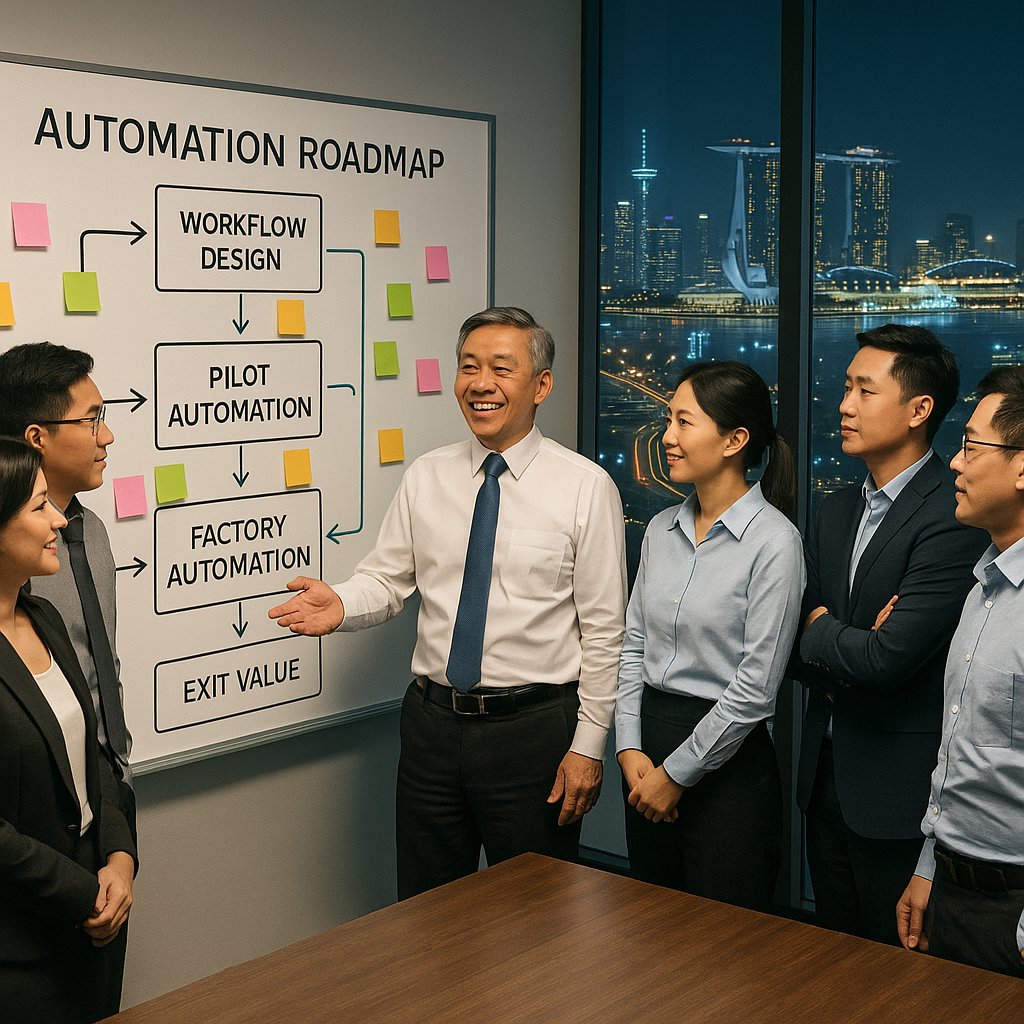

Designing an Automation Roadmap: From Sales to Financial Reporting

Effective automation starts with clarity about which processes genuinely drive value. In Singapore, advisory firms such as PwC Singaporeemphasise a business-led approach: you define the outcomes, then apply technology, not the other way round.

For most SMEs and mid-market firms, four domains usually deliver the fastest returns when automated:

- Sales and revenue workflows

Modern sales automation platforms (for example, HashMicro CRM Sales or global tools like HubSpot and others described by HashMicro) centralise lead capture, automated follow-ups, quotation workflows and pipeline analytics. According to industry research, the global sales automation market is growing steadily, and Singapore businesses are at the forefront of adoption, particularly in B2B and service sectors. - Order-to-cash and customer lifecycle

Automated invoicing, dunning emails, subscription renewals and self-service customer portals reduce delays and disputes. Integrated systems help ensure every closed deal flows correctly into billing, collections and revenue recognition. - Financial reporting and compliance

Intelligent automation in financial reportinguses technologies like robotic process automation (RPA) and machine learning to streamline reconciliations, journal postings and control checks. For SMEs, even basic rules-based automation can cut month-end close times and reduce manual errors that worry lenders or buyers. - Operations and inventory

Integration between ERP, inventory and production systems supports just-in-time replenishment, automated purchase triggers and improved demand forecasting. For businesses with physical goods, linking this to sales data is crucial for working capital control.

To build a roadmap, list your critical processes, then score each by:

- Repetition and manual effort

- Error rate and rework cost

- Impact on revenue, cash flow, or compliance

- Data availability and current system maturity

Start with a small cluster of processes with high impact and relatively low complexity. For instance, an SME might first automate lead capture and follow-ups, then move to invoice generation and bank reconciliation, and only later look at more advanced analytics or AI-based forecasting.

Industrial, Building and Factory Automation: What SME Owners Should Watch

Beyond software workflows, Singapore also has a fast-evolving landscape in industrial and building automation. Reports on the industrial control and factory automation market in Singaporehighlight growing demand for programmable logic controllers (PLCs), human–machine interfaces (HMIs), and integrated control systems, driven by manufacturing, logistics and process industries.

Similarly, analysis of the building automation systems market in Singaporepoints to sustained investment in smart building technologies: HVAC optimisation, lighting control, security integration and energy monitoring. There is also specific interest in control units for automation, which serve as the backbone for these integrated systems.

For SME owners, the implications are practical:

- Production consistency and labour productivity

Factory automation and control systems help standardise output quality and reduce dependency on manual labour, which is crucial in a tight labour market with rising wages and foreign manpower constraints. - Energy and facility costs

Building automation solutions can significantly lower energy consumption and support ESG goals. This can be a differentiator when negotiating leases, financing, or government support. - Data from the physical world

Sensors and control units generate real-time data on machine health, throughput and downtime. When integrated with ERP and analytics, this enables predictive maintenance and better capital planning. - Vendor and integration risk

Before engaging any automation company, resources like

“automation company in Singapore: 10 things you should know first”stress due diligence on track record, integration capability, cybersecurity posture and long-term support.

Entrepreneurs considering capital-intensive automation should also look at sector perspectives. For example, interviews such as the one with Apparao Myneni on GBReportshighlight how automation, AI and data platforms are reshaping global competitiveness and operating models. The key takeaway: automation is no longer a one-off capex decision, but an ongoing capability that must evolve with your market.

Financing Automation: Credit, Cash Flow and Risk Management

Even when the ROI is clear, many SMEs delay automation because of upfront cost and uncertainty about financing. In Singapore, there are several levers you can use to support your automation roadmap while managing risk.

1. Using SME loans strategically

Specialised guides such as SingSaver’s overview of the best SME business loans in Singaporeshow that banks and alternative lenders are actively competing to fund working capital, equipment and technology adoption. When considering such loans:

- Match loan tenure to the useful life of the automation asset.

- Stress-test cash flow assuming conservative savings and revenue uplift.

- Clarify whether the facility is secured (e.g. by assets) or unsecured, and how that affects your flexibility.

2. Managing credit card and short-term borrowing

It can be tempting to put software subscriptions or even hardware on business credit cards. However, high-interest revolving debt can quickly erode automation gains. Resources like SingSaver’s credit card debt guidesemphasise the importance of avoiding long-term rollovers and understanding total cost of borrowing. For SMEs, this translates into:

- Using cards for short-term cash flow smoothing only, with clear repayment discipline.

- Avoiding structural dependence on high-cost revolving credit for core automation capex.

- Negotiating annual or multi-year SaaS deals directly with vendors to secure discounts and consistent terms.

3. Linking automation to investment returns

Investors tracking the best performing stocksoften favour companies with high operational leverage and scalable processes – both outcomes of successful automation. At the SME level, you can apply the same thinking:

- Quantify how automation improves gross margins, operating margins and working capital days.

- Track KPIs such as revenue per employee, order cycle time and error rates before and after deployment.

- Use these metrics to make an internal “investment case” and to communicate with lenders or equity partners.

When automation initiatives are clearly tied to measurable financial improvements, it becomes much easier to secure external funding and internal buy-in.

Automation, Exit Strategy and Buying a Business for Sale in Singapore

Automation increasingly influences both sides of an M&A transaction: buyers seek systemised businesses, and sellers can command better valuations if their operations are automated and well-documented.

1. What buyers should look for

When reviewing a business for sale in singapore, automation should be part of your commercial and operational due diligence:

- Sales and CRM: Are leads, opportunities and customer histories centralised, or scattered across spreadsheets and inboxes? Are there any sales automation or CRM platforms in place, such as HashMicro CRM Sales or equivalent?

- Financial processes: Is there any intelligent automation in reconciliations, reporting or compliance? Are closing timelines short and consistent, or dependent on a few key individuals?

- Industrial and building systems: In asset-heavy or facility-based businesses, assess the maturity of factory automation, control systems and building automation. Well-integrated systems often signal better cost control and resilience.

- Vendor dependence: Determine whether crucial automation systems are supported by reputable providers with clear SLAs, or ad hoc freelancers. Sudden loss of support can be a hidden operational risk.

Strength in these areas can justify a premium, as they reduce transition risk and integration cost post-acquisition.

2. How owners can “automation-ready” their exit

For founders planning an eventual sale or partial exit, think of automation as a value-creation program:

- Document processes as you automate them so a buyer can understand and maintain your workflows without relying solely on staff knowledge.

- Ensure your automation stack (CRM, ERP, accounting, control systems) is built on widely supported platforms or open standards to reduce integration friction.

- Align automation metrics with how buyers think: recurring revenue, customer retention, margin stability, and capital efficiency.

This positioning also influences potential acquirers such as regional corporates or private investors who actively scan marketplaces and brokers for systemised, low-touch businesses.

3. When automation unlocks new acquisition strategies

Automation can also enable acquisition-led growth. If your team has strong expertise in implementing sales, finance or factory automation, you can buy under-automated companies and systematically uplift their performance. Over time, this “playbook” can justify higher valuations and easier financing for follow-on deals.

If you are actively exploring targets, you can use curated listings like business for sale in singaporeto identify sectors where your automation capabilities create the biggest transformation upside.

To manage the legal, tax and structuring complexity of such acquisitions, consider working with an experienced Singapore-focused intermediary. Bizlah helps connect owners and buyers, streamline deal processes, and align automation improvements with long-term growth. You can explore opportunities or seek guidance via Bizlah’s business marketplaceas a starting point.

Conclusion: Treat Automation as a Long-Term Capability, Not a One-Off Project

Across Singapore’s economy – from SaaS-driven sales teams to factory floors and smart buildings – automation is shifting from optional efficiency gains to core competitive infrastructure. Intelligent automation in sales, finance and reporting improves accuracy and speed; industrial and building automation enhances reliability, safety and energy performance; and together they shape financing options, investor appeal and exit value.

For founders and investors, the key is to treat automation as a long-term capability: start with a focused roadmap, finance it prudently, measure the impact rigorously, and ensure systems stay adaptable as your business model evolves. Whether you are strengthening an existing SME or evaluating a business for sale in singapore, a deliberate automation strategy can be the difference between incremental improvement and step-change growth.

FAQ

Q:

How should a Singapore SME prioritise which business processes to automate first?

A:Start by mapping your core customer, revenue and compliance workflows, then score each process by impact (time saved, error reduction, revenue upside) and ease of implementation. Prioritise high-impact, low-complexity use cases in sales, invoicing and reporting before tackling cross-department or deeply customised workflows.

Q:

How can automation directly support fundraising or bank financing for my business?

A:Well-implemented automation creates clean, timely data on revenue, margins and cash flow that lenders and investors can trust. You can also use automated dashboards and audit trails to demonstrate control, scalability and reduced key-person risk during due diligence.

Q:

What’s the difference between buying automation tools and having an automation strategy?

A:Buying tools focuses on features and quick fixes, often resulting in isolated apps that don’t talk to each other. An automation strategy defines business goals, data flows, ownership and success metrics first, then selects tools that fit the overall architecture and exit plan.

Q:

How do I prevent automation from increasing risks instead of reducing them?

A:Design your automations with clear approvals, exception handling and logging from day one. Limit access rights, separate duties for sensitive workflows like payments, and review key automations quarterly to catch broken integrations or workarounds staff may have created.

Q:

How does automation influence my company’s exit value to acquirers?

A:Acquirers pay more for businesses with predictable, well-documented and easily scalable processes. Automation that standardises sales, finance and operations—and surfaces accurate KPIs in real time—reduces transition risk and integration costs, which can justify a higher valuation multiple.

Related Reading

Work with Bizlah

consultative CTA — explore Sell or Buy a Business.

- Local expertise in Singapore

- End-to-end guidance

- Transparent valuation

- Automation Plays for Singapore SME Buyers: From AI Platforms to Industrial Assets

- Automation Advantage: What Serious Buyers Should Check Before Acquiring a Business for Sale in Singapore

Informational only; not financial advice.