Automation-Focused Acquisitions in Singapore: Where to Find Deals and How to Judge Quality

Table of Contents

- Overview: Why Automation-Heavy Acquisitions Deserve a Premium

- Where Automation-Rich Deals Are Hiding in the Singapore Market

- Judging Operational Depth: What Automation Really Means in a Listing

- Technical Due Diligence: From Factory Floors to HMI Screens

- Evaluating Financials and Grants: Making Automation Pay for Itself

- Lifestyle Automation Plays: Vending, Franchises, and Online Systems

- Deal Structures and Exit Angles in Automation-Heavy Sectors

- How Bizlah Can Help You Navigate Automation-Driven Acquisitions

- FAQ: Buying Automation-Heavy Businesses in Singapore

- Conclusion: Treat Automation as the Core Asset, Not a Side Feature

- Work with Bizlah

Overview: Why Automation-Heavy Acquisitions Deserve a Premium

Expert Insight:

According to industrial M&A platform SMERGERS, this company is a multi-disciplinary engineering and automation EPC provider with diversified revenues across four core verticals—industrial automation, turnkey EPC projects, water & wastewater treatment, and precision engineering/manufacturing—serving sectors from automotive and EV to pharmaceuticals and F&B, supported by ISO 9001:2015-certified operations and teams in India and the UAE (https://www.smergers.com/industrial-automation-businesses-for-sale-and-investment/s1527b/). (www.smergers.com)

In Singapore, automation is no longer a niche capability. Learn more: Sell or Buy a Business.It is baked into manufacturing, logistics, finance, and even lifestyle businesses like vending and dropshipping. For buyers scanning any kind of business for sale in Singapore, automation is now a key driver of valuation: it can compress staffing needs, stabilise margins, and make revenue more scalable.

This article takes a dealmaker’s view of automation. Instead of listing generic benefits of robots and software, it focuses on where automation-rich businesses show up in the market, how to interpret those listings, and what to verify from the factory floor to cloud dashboards before closing. The goal is to help you distinguish a genuinely systemised operation from one that just uses a few gadgets and buzzwords.

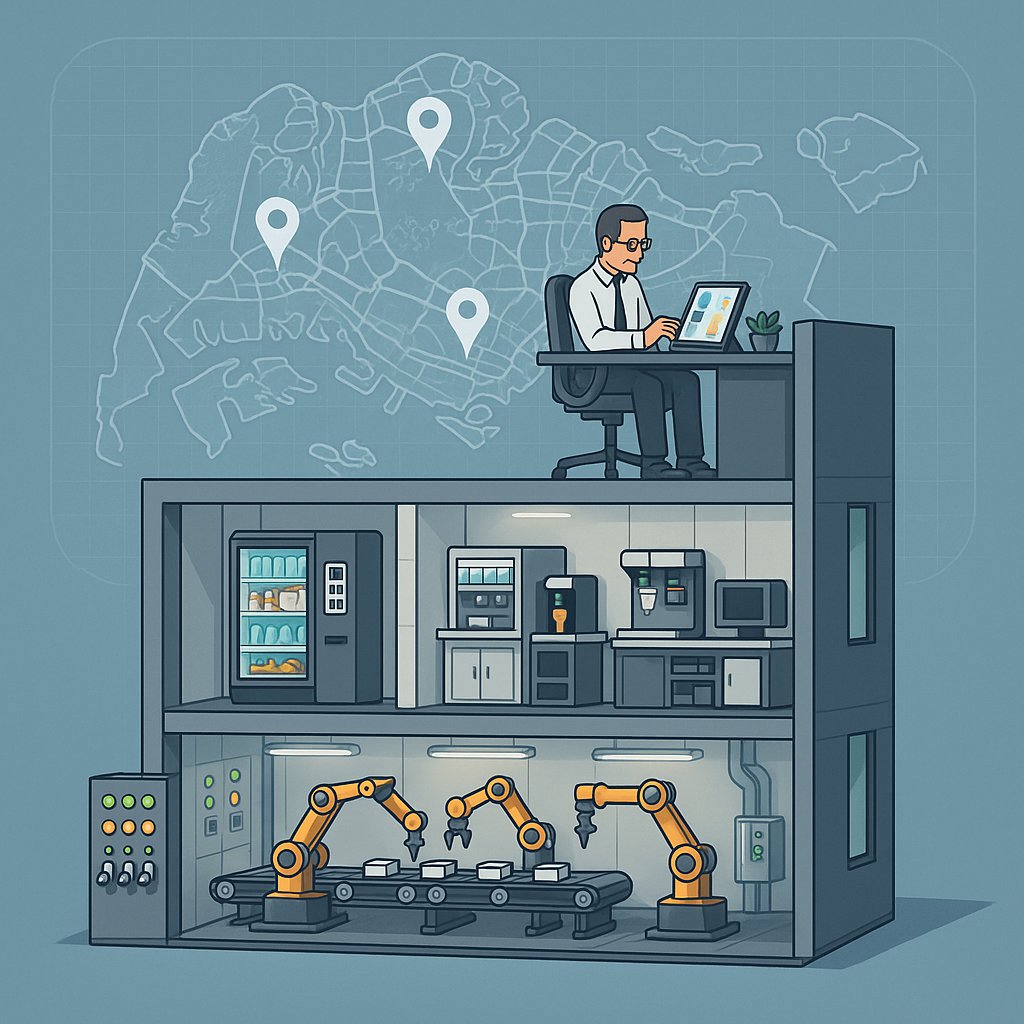

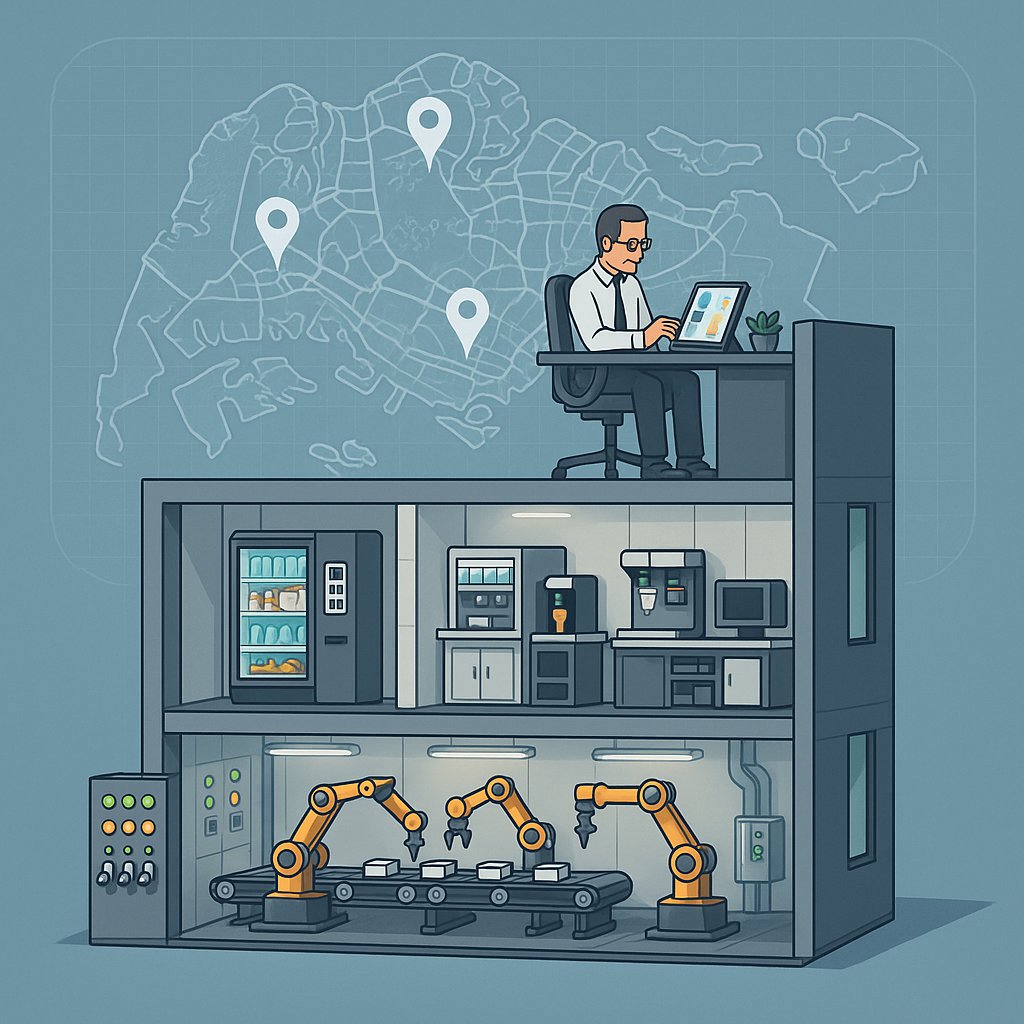

Where Automation-Rich Deals Are Hiding in the Singapore Market

Automation does not appear only in industrial plants. If you scan listing platforms and data sources, you will see it woven through multiple categories of business for sale in Singapore.

- Industrial automation and EPC players– Portals like SMERGERSshowcase multi-disciplinary engineering and automation companies that deliver turnkey projects, water and wastewater systems, and precision fabrication. These are often multi-vertical and project-driven, with revenue from equipment, integration services, and long-term maintenance contracts.

- Precision engineering and component manufacturers– Listings on BusinessForSale.sgregularly feature precision engineering shops in hubs like Bukit Batok and Mandai. Many serve semiconductors, aerospace, automotive, oil and gas, and defence, and depend on CNC machines, automated inspection, and tightly controlled workflows.

- General manufacturing businesses– The broader manufacturing category on BusinessForSale.sgincludes furniture, fixtures, and light-industrial units. Even when a listing only advertises a factory unit and assets (e.g. a carpentry workshop in Mandai), there may already be jigs, templates, and semi-automated processes that shorten learning curves for new owners.

- Automation machinery and factory automation firms– B2B data sources such as Lusha’s automation machinery searchand solution marketplaces like ensun’s factory automation directoryhighlight machine builders, integrators, and robotics solution providers. While not all are openly for sale, these are prime targets for direct approaches or bolt-on acquisitions.

- Software-led automation platforms– Built In Singapore’s overview of automation companiessurfaces SaaS and AI-based players such as HashMicro (ERP and automation software) and logistics automation specialists like A-Plus Automation. These can be acquired outright, partnered with, or integrated into traditional businesses you already own.

- Fully online, automated businesses– Marketplaces sometimes list fully automated dropshipping storesthat rely on e‑commerce platforms, supplier integrations, and marketing automations. Here, the “factory” is digital: the asset is the system stack plus traffic channels, not physical equipment.

Across these categories, the unifying theme is not technology for its own sake, but how deeply processes have been encoded into systems. That depth is what you are ultimately buying.

Judging Operational Depth: What Automation Really Means in a Listing

Many listings use the word “automated” loosely, so you need a sharper lens to gauge operational depth.

- Look for multi-stream, systemised revenue– Strong industrial automation firms often have diversified verticals (e.g. industrial automation systems, EPC projects, water treatment, precision fabrication). Recurring revenue from maintenance contracts, software licences, or SLAs is a good sign that automation is part of long-term client relationships instead of just project hardware.

- Check utilisation and throughput– A manufacturer running at or near full capacity (for example, 150 tons per month fully utilised) with a small workforce often indicates well-optimised machinery, good production planning software, and standardised workflows. Ask how output would scale with incremental capex or shift changes.

- Map automation to labour intensity– Compare headcount against revenue and output. Precision engineering shops supplying semiconductors or aerospace components usually rely heavily on CNC, CMM, and automated tooling setups; a lean staff producing complex, high-tolerance parts suggests mature automation.

- Assess lead conversion and client concentration– When a seller mentions turning a handful of prospects into ongoing clients, ask what systems underpin that: CRM automation, proposal templates, standardised project designs, and post-project follow-up sequences can all reduce dependency on the founder’s personal relationships.

- Differentiate equipment from integration– A plant may have modern machines, but the real value is in PLC logic, SCADA platforms, recipe libraries, and fault-handling routines. Check whether OEMs, integrators, or in-house teams built these—your future upgrade paths and support options depend on it.

Automation’s value shows up in consistency: predictable margins, stable lead times, and minimal variance in quality, even when staff change or volumes spike.

Technical Due Diligence: From Factory Floors to HMI Screens

Technical diligence on an automation-heavy business goes deeper than checking that machines turn on. You are evaluating an entire control ecosystem.

- Control architecture and vendor stack– Identify the major PLC, drive, and HMI platforms in use (e.g. Siemens, Schneider Electric, Allen‑Bradley, Weintek, Red Lion). In automated packaging lines, for example, HMI panels are tied into PLCs, sensors, VFDs, and inspection units via protocols such as Modbus TCP, Ethernet/IP, or PROFINET. Ask for network diagrams, bill of materials, and software version lists.

- HMI and SCADA design quality– Observe how operators interact with the system in real time. Effective HMIs centralise alarm states, production counts, and diagnostics on intuitive screens. Poorly designed screens force staff to click through multiple menus to solve simple issues, leading to higher downtime and training costs.

- Code and configuration ownership– Ensure your future company owns source code, project files (for TIA Portal, Vijeo Designer, EasyBuilder Pro, or other tools), recipes, and library blocks. If integrators retained ownership, you may be locked into specific vendors or face high fees for modifications.

- Spare parts and obsolescence risk– Check whether any critical HMIs or PLCs are discontinued. Good sellers will already have strategies to substitute equivalents or compatible hardware sourced from reliable channels. Factor in the cost and lead time of upgrading legacy devices to current-generation models.

- Data collection and reporting– Leading Singapore firms are moving toward intelligent automation, not just basic control. In industrial settings, that means production data logged centrally for OEE reporting; in finance, PwC’s work on intelligent automation in financial reportingshows how RPA and workflows can tighten controls and accelerate consolidation. Ask how the target business captures, stores, and uses data today.

- Safety, certification, and documentation– Verify ISO certificates (e.g. ISO 9001:2015), electrical safety standards, and risk assessments for automated lines. Documentation should cover operating procedures, lockout-tagout steps, and maintenance routines.

Well-structured automation environments are often underwritten by good documentation and disciplined change control. If everything lives “in the head” of a single engineer, treat that as a red flag and negotiation lever.

Evaluating Financials and Grants: Making Automation Pay for Itself

Automation-heavy businesses can be capital intensive, but in Singapore you can offset part of that burden through smarter deal structuring and grants.

- Normalize earnings for maintenance and upgrades– Ask for a five-year history of capex on machinery, software, and major plant upgrades, then build a realistic maintenance and replacement schedule. A factory running heavily utilised equipment at 150 tons per month will require periodic overhauls; underestimating this will inflate your expectations of free cash flow.

- Separate project from recurring revenue– For industrial automation integrators and EPC firms, most revenue may come from projects. Break down margins by project type and size, and pay special attention to recurring engineering support, AMC contracts, or software fee streams—these are the stabilisers that justify higher valuations.

- Factor Singapore SME grants into your investment thesis– As outlined by SingSaver’s guide to SME grants, schemes such as the Productivity Solutions Grant (PSG) and the Enterprise Development Grant (EDG) can co-fund automation software, robotics, and process redesign. When modelling post-acquisition upgrades, include these offsets; they can significantly improve ROI.

- Model headcount productivity– Track revenue per full-time employee pre- and post-automation investments. Intelligent automation case studies from firms like PwC Singaporeshow that well-designed automation can reduce manual processing times by 30–70%. Incorporate similar benchmarks cautiously into your scenarios.

- Stress-test against order volatility– For project-based businesses, run scenarios where orders from key verticals (e.g. oil and gas, automotive, or semiconductors) dip 20–30%. Strong automation firms balance exposure across industries and geographies; weak ones are overly dependent on a handful of customers.

Ultimately, automation should protect margins and enhance downside resilience, not just pump top-line revenue during good years.

Lifestyle Automation Plays: Vending, Franchises, and Online Systems

Not every automation-centric deal involves industrial machinery. Singapore’s dense urban environment and digital adoption have opened up “lifestyle automation” plays, many of which are accessible to first-time buyers.

- Vending machine businesses– SingSaver’s guide to starting a vending machine business in Singaporehighlights remote telemetry, cashless payments, and inventory monitoring as key enablers. When you see a vending operation or route-based business for sale in Singapore, assess how far they have gone beyond basic machines: do they have real-time dashboards, centralised pricing updates, and automated stock alerts?

- Franchises with systemised operations– Strong franchise brands, profiled in SingSaver’s overview of franchise opportunities in Singapore, trade on process and automation rather than only logos. Evaluate POS integrations, supply chain platforms, labour scheduling tools, and marketing automation that come bundled with franchise fees.

- Fully automated e‑commerce and dropshipping– A fully automated dropshipping businessmay use store platforms, payment gateways, supplier APIs, and ad automation to minimise human touch points. Inspect integrations with marketplaces, abandoned-cart campaigns, and customer support workflows. Many such businesses are only “semi-automated” in practice, still relying on manual order checks or ad adjustments.

- Hybrid physical-digital funnels– Some owners pair vending, small retail kiosks, or events with automated CRM sequences and subscription offers. These combinations allow busy professionals to run side businesses with relatively low time input, as long as the underlying automations are robust.

For lifestyle automation plays, your biggest risks often lie in traffic volatility and platform dependence rather than hardware failure. Traffic sources, search rankings, and ad accounts deserve just as much scrutiny as machine uptime statistics.

Deal Structures and Exit Angles in Automation-Heavy Sectors

Automation-focused acquisitions can support more nuanced deal structures and exit plans than traditional SMEs.

- Asset vs share purchases– In industrial or precision engineering deals from sites like BusinessForSale.sg, you might buy either just the machine park and factory lease (as in certain carpentry factory takeovers) or the operating company with contracts, staff, and IP. Asset deals can shield you from legacy liabilities but may complicate customer and vendor transitions.

- Earn-outs tied to automation KPIs– Where founders claim significant efficiency gains from recently installed automation, consider tying part of the purchase price to realised savings or throughput targets. For example, bonuses could be linked to achieving predefined OEE levels, headcount reductions without loss of capacity, or upgrade projects delivered on budget.

- Vendor partnerships and white-label options– With automation machinery manufacturers and integrators identified via Lushaor ensun, an acquisition can be combined with distribution rights or white-label arrangements in other markets. That creates multiple exit options: selling the local operations, the IP, or a roll-up of several integrators.

- Strategic exits to larger engineering groups– As seen in listings for pioneering automation solution providers, mature automation firms are attractive bolt-ons for regional engineering conglomerates. Building standardised processes, clear technology stacks, and auditable financials now can significantly increase your eventual sale multiple.

- Leveraging automation for faster deleveraging– When buying a business for sale in Singapore with financing, automation-driven cash flow improvements can shorten your payback period. Use conservative assumptions on efficiency gains, and earmark a portion of those savings explicitly for debt reduction in your financial model.

Because automation assets are tangible and often financeable, you can blend traditional bank loans, equipment leasing, and, in some cases, vendor financing from OEMs to structure capital-efficient deals.

How Bizlah Can Help You Navigate Automation-Driven Acquisitions

Automation changes the way you should evaluate, structure, and grow deals—but it also introduces technical and strategic blind spots. That is where a specialist lens helps.

- Deal sourcing with an automation filter– Instead of trawling every business for sale in Singapore, you can prioritise listings and off-market opportunities where automation already underpins margins or can be introduced quickly for step-change improvements.

- Technical-commercial translation– From interpreting PLC and HMI setups on the factory floor to assessing no-code and SaaS stacks in online businesses, Bizlah helps you connect technical detail to commercial value: resilience, scalability, and exit potential.

- Grant and financing alignment– By mapping your automation roadmap against relevant Singapore grants and financing instruments, you can upgrade systems post-acquisition without overstretching working capital.

- Post-acquisition automation strategy– Beyond closing, Bizlah works with owners to standardise processes, consolidate tech stacks across portfolio companies, and prepare clean data rooms for future exits.

If you are actively reviewing an automation-focused business for sale in Singapore and want a structured, investor-grade view of the opportunity, you can work with Bizlah’s deal advisory teamto stress-test your thesis before you commit.

FAQ: Buying Automation-Heavy Businesses in Singapore

1. Why do automation-heavy businesses often command higher multiples?

Because automation embeds know-how into systems rather than individuals, it reduces key-person risk, stabilises margins, and increases scalability. Buyers are willing to pay a premium for predictable throughput, lower labour intensity, and better data visibility, all of which support stronger growth and cleaner exits.

2. How can I verify that a “fully automated” online business is not overstated?

Request a complete walkthrough of the tech stack: e‑commerce platform, payment gateways, supplier integrations, marketing automations, and support tools. Check how many steps still require manual intervention (order checks, refunds, ad optimisations). Review activity logs and SOPs to verify that day-to-day operations truly run with minimal human input.

3. What special risks come with buying industrial automation integrators?

Key risks include project concentration (a few big clients), dependency on specific engineers, and exposure to legacy hardware or software that is hard to support. Mitigate them by reviewing order backlogs across industries, mapping client relationships, confirming source code and documentation ownership, and assessing how quickly new engineers can learn the system.

4. Can I retrofit automation into a traditional business I acquire?

Yes, especially in manufacturing, logistics, and service workflows with repetitive tasks. In Singapore, grants such as PSG and EDG can co-fund software and equipment. The key is to start with process mapping, identify bottlenecks with the highest labour or error cost, and then introduce targeted automation (e.g. inventory systems, RPA bots, or simple sensors) rather than chasing expensive, all-encompassing solutions.

5. How does automation affect staff and culture during a takeover?

Staff may be anxious about job security or unfamiliar tools. Communicate early that automation is meant to remove low-value tasks, not replace every role. Provide training, reskill people into higher-value activities (quality, analysis, customer-facing work), and tie incentives to the successful adoption of new systems. Businesses that manage this transition well often see both morale and performance improve.

6. What is the most overlooked factor when valuing automation assets?

Integration quality is frequently overlooked. Two plants can own similar machines, but the one with well-designed PLC logic, robust HMIs, clear documentation, and standardised recipes is far more valuable. Always assess how seamlessly systems work together, how easy they are to modify, and how dependent they are on a small number of individuals.

Conclusion: Treat Automation as the Core Asset, Not a Side Feature

Whether you are eyeing a precision engineering shop, a factory automation integrator, a vending route, or a cloud-based dropshipping store, automation is the thread that links their long-term value. The real asset is not just equipment or code; it is the way those systems institutionalise know-how, compress labour, and create repeatable outcomes.

When you scan the market for a business for sale in Singapore, read automation claims critically, dig into both technical and financial details, and model how incremental automation can further enhance returns. With the right lens, you will see that some of the most attractive deals in Singapore are not simply profitable—they are quietly, systematically automated.

Related Reading

Work with Bizlah

consultative CTA — explore Sell or Buy a Business.

- Local expertise in Singapore

- End-to-end guidance

- Transparent valuation

- Automation Business Landscape in Singapore: Sectors, Deal Types, and Practical Entry Paths for SME Buyers

Informational only; not financial advice.